Chưa có sản phẩm trong giỏ hàng.

Bookkeeping

Law Firm Accounting and Bookkeeping: Tips and Best Practices JurisPage Legal Marketing

Content

This leaves you with the purchase of additional non-legal accounting software. As a result, you’re left with multiple platforms and an accounting system that is not tailored specifically for law firms. Keeping accurate records of your law firm’s accounts is a challenging yet vital part of running a legal practice.

You should also inquire into each candidate’s education and training related to legal accounting. You will also want to inquire about their relevant education and training in bookkeeping and financial account management. While each account is managed in accordance with https://www.bookstime.com/ the law of the state, they have common rules guiding them. But lawyer accounting involves more than simply preparing tax returns and complying with relevant ethical and regulatory guidelines. You can’t wait until right before tax time to start tracking your finances.

You want to know where your money is going

We found Lescault & Walderman while setting up our new law firm. As lawyers, we didn’t want to focus on the day-to-day of our firm’s accounting. They check-in with us weekly or more, and they maintain and upgrade our financial systems as our firm continues to grow. They always give us good folks to work with; we enjoy working with them. This will help you in determining growth and better reading current practices.

For an in-depth discussion about the rise of electronic payments in the American legal profession, check out this guide to payment processing from the American Bar Association. Once you’ve determined what kinds of payments your firm will accept, you’ll then need to choose a payment provider to work with. Most law firms opt to use cash basis accounting because it’s simple to maintain.

How Law Firm Accounting Software Can Help

While on-premise accounting software ties you to a physical location and requires high maintenance costs and time-consuming updates, cloud-based accounting software is accessible anywhere. Cloud-based accounting software for law firms also automatically gets updated and backed up, offering unparalleled, real-time insights into your firm’s financial data. Law firm bookkeeping records the financial transactions and balances the financial accounts for your firm. Legal bookkeeping takes place before any accounting can occur and is an essential administrative task for any law firm.

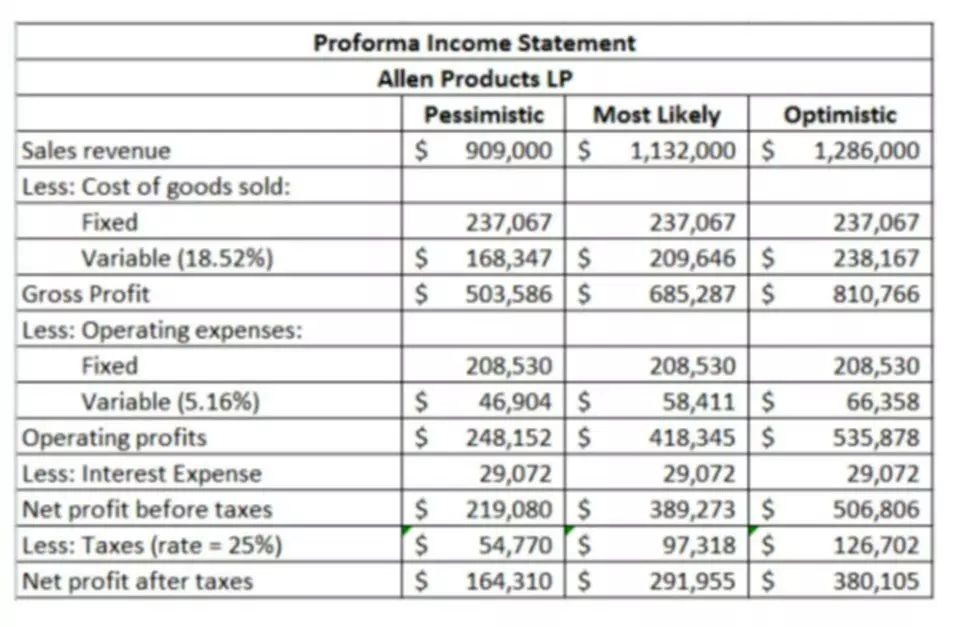

Practice Alchemyʼs team of legal bookkeeping experts know how to build and deploy successful bookkeeping programs to ensure your books are diligently and accurately kept. Offload your firm’s day-to-day legal bookkeeping needs so you can focus on what really matters. No matter how much you love your business there are always more things in life we want to be doing other than working. The Profit and Loss report, also known as an Income Statement, shows the revenue and expenses of your business over a particular period of time.

Monthly Financial Statements

We help you by providing peace of mind that your IOLTA is accounted for properly and all client funds are protected. During that time, you likely did not learn anything about legal accounting or bookkeeping. So the thought of legal bookkeeping and law firm accounting can sound intimidating to even the most experienced attorneys. They can choose either cash accounting for law firms or accrual accounting for law firms. One of these is to maintain detailed and comprehensive records for their client’s trust accounts.

See what strategic opportunities you have for reinvestment and plug those into your budget. If you’re trending behind, it is better to know sooner rather than later so you can react accordingly. With all the options available, we know it’s difficult to choose which software is the best choice for your firm. After all, you have to sift through the options alone, convince your partners to agree, and pray that it works as it should.

How to choose an accountant for your firm

In law firms, legal bookkeeping takes place first and relates to the administrative side of tracking cash. ProFix Accounting & Strategy is a specialized firm offering exclusive finance and accounting services to law firms, led by Anna DiBella, CPA, CGA. With over a decade of experience in trust accounting, ProFix is one of the only CPA firms offering this specialization to clients. Understanding the function and scope of a law firm is tantamount to working with one.

- An attorney has an ethical duty to keep client funds separate from law firm operating funds.

- If everything is jumbled into one account, come tax time, you or your CPA will have to go through your bank records to figure out which expenses are related to your business.

- Double-entry accounting can create a balance sheet made of equity, liabilities, and assets.

- Generally, the two allowable options are the cash basis and the accrual basis.

- Whether intentional or through neglect, violations of compliance regulations—like mishandling client funds—can lead to serious repercussions.

In states that allow it, you’d deposit just enough to cover the fees. FreshBooks is considered one of the best legal software for law firm accounting. It’s a cloud-based accounting software that works well for those in need of small law firm accounting software. Whether it’s mixing up your business and personal transactions or deducting an expense from the wrong client trust account, it’s easy for law firm owners to record transactions incorrectly.

Join thousands of clients nationwide.

You should budget for an accountant and bookkeeper to assist you with managing your firm’s finances and ensuring you’re compliant with ethics regulations. To do this, legal accountants capture expenses, provide financial forecasting, and prepare financial statements. Legal accountants look at the bigger picture, using the data law firm bookkeeping your bookkeeper provides to determine how your firm can improve its financial health. And while you learned the ins and outs of the legal system in law school, they didn’t teach you about accounting and bookkeeping. Your business’s accounting method will affect cash flow, tax filing, and even how you do your bookkeeping.

- This can cause serious issues and stunt your firm’s growth (more on that later).

- A trust account is a special bank account where client funds are kept safe and in a separate account from law firm operating funds.

- The tax implications of this method also allow your firm to pay tax on income once it’s received and in the bank.

- You can only move CTA funds into your business operating account after your client approves an invoice.

- These best practices all come back to one idea — staying organized.

A law firm accountant and bookkeeper typically work towards the same goal–they both want to track your firm’s financial performance and ensure that information is up-to-date and accurate. But, they support your business in different stages of the financial cycle. From sending payment requests and tracking them to integrating with your go-to legal software products, LawPay will fit your needs. LawPay also ensures your law firm accepts payments that comply with your state bar’s regulations surrounding trust (IOLTA) accounts and the American Bar Association (ABA) guidelines. Though rules vary from state to state, most state Bar Association rules permit debit, credit and other electronic payment processing for law firms.

Whether you do the task yourself or outsource it to a pro, the goal is to make sure your books are accurate, up-to-date, and useful to you and your CPA. Whatever the reason, borrowing from an IOLTA is one of the most common ways to get disbarred. Once you’ve chosen an accountant to work with, use these questions to guide your initial conversation. A CPA can also help you make long-term, big picture budgeting decisions about the future of your business. If you’re serious about growing your business, you need to team up with a Certified Public Accountant (CPA) early on.